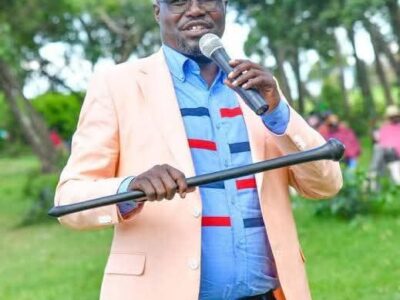

Nairobi Senator Miko Sonko has a word for you, especially if you have poor financial management skills. The flamboyant Senator says “it’s not what you earn that matters but what you save. See his inspiring advice:

“Watu wangu You may know how to earn money. You may be in a job with a comfortable salary or own a business that can afford to pay you quite well. You may even be in a job that is financially related such as an investment adviser, accountant etc. It does not mean you know how to create wealth. Most people mistake earning a good salary or having the correct job title with being able to create wealth or worse still “being wealthy”. The two are worlds apart.

How much can you keep of what you earn? James is earning Kshs 400,000 per month as a banker. His expenses inclusive of a home mortgage and car loans he is servicing come to Kshs 350,000 per month. He is able to save Kes 50,000 per month. Muthoni, who works as a farm manager earns Kshs 50,000 per month. Her expenses are Kshs 30,000. She is able to save Ksh 20,000 per month. It may look like James is saving more but in comparison to his lifestyle he is not. He is saving only 13% of his salary whilst Muthoni saves 40%.

How fast you can grow it so that it can accumulate to something that can eventually support you? James is busy and has therefore opted to leave his money with a fund manager to place in Unit Trusts. Muthoni has decided to pool her Kshs 20,000 per month together in a Chama with 5 people. They therefore raise Kshs 100,000 per month. In three months they were able to get enough funds to lease some land and start growing tomatoes. After all expenses are paid including hiring of a manager, the project generates an income of Kshs 30,000 per month. They have decided for the next 5 years to keep retaining the money in the business, continue with their monthly contributions and acquire more land and continue growing tomatoes. With Muthoni’s expertise they expect to be earning on a conservative basis Kshs 250,000 per month by then. This means each person will be taking home Kshs 50,000 per month at that time.

The true wealth creator is Muthoni. In those 5 years, Muthoni will have put aside a total of Kshs 1.2 million as her contribution into the project in 5 years. She will then start making Kshs 50,000 (which she can actually live on) per month and will have recouped her investment in two years. After that her project will be giving her income as long as it is still ongoing. James, despite his commercial know how of finance has not made use of it for his own benefit but has instead taken a very passive approach to his personal investments. Even if his investments were to give him 15% return per annum, in 5 years he would accumulate Kshs 4.5 million. Based on his lifestyle he would only be able to survive for about a year on this. It is not generating an income for him so he still needs to keep pouring in more and more money which will take longer for it to work for him.

So watu wangu always remember it is never what you earn but what you can push yourself to do with it. A little can do a lot and there is always somewhere to start”