Uwezo Fund is a Kenyan Government initiative which is aimed at empowering Kenyans through cheap loans. The loans are helpful particularly to the youths, woman and Kenyans with entrepreneurial skills but lack funds to boost their businesses.

Eligibility Criteria for Applicants.

Applicants shall qualify for Fund loan application if

(a) For a group

i. Is registered with the department of social services, Cooperatives or the Registrar of Societies

ii. Has members aged between 18 and 35 years whereas the women’s groups shall be made up of women aged eighteen years and above

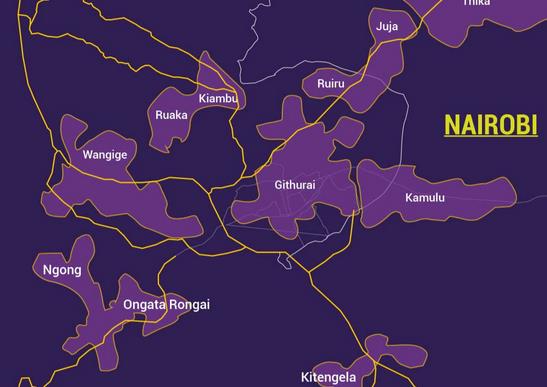

iii. Is based and operational at the constituency it seeks to make an application for consideration

iv. Operates a table banking structure or any other group fund structure where members make monthly contributions according to the groups’ internal guidelines (evidence of monthly contributions shall be a requirement);

v. Hold a bank account in the name of the group.

(b) For an institution

i. Is a registered entity

ii. Has listed youth and women groups within it.

How to apply

Step 1: Ensure that you meet the eligibility criteria above

Step 2: Fill in an application form (available from the Constituency Uwezo Fund Management Committee office, CDF Offices or download form from

Step 3: Submit the application form together with relevant documents to the Constituency Uwezo Fund Management Committee office

Step 4: Await notification from the committee

ELIGIBLE AMOUNT

(a) For administration of the Fund:-

i. The access by eligible groups of the Fund, shall be on a first come first served basis, subject to assessment and approval of the loan, provided that the Committee shall ensure equitable distribution of funds in the wards

ii. Eligible qualifying amounts for a group shall be a minimum of fifty thousand 50,000) and a maximum of five hundred thousand (500,000) shillings at any one time.

(b) In determining the total amount a group is eligible toreceive, the following criteria shall be applied:-

i. The length of time the group has been in existence

ii. The total amount contributed by the group

iii. The current status of contribution and

iv. The proposed business plan for the loan applied

NB: The eligible amount shall be three times the group savings BUT it shall not be:-

i. Below Kshs. 50,000 (Minimum),

ii. More than the amount applied for in the application form and

iii. More than Kshs. 500,000 (Maximum)

If you believe you have the ability to succeed in entrepreneurship, apply for this fund, it will go a long way in making you one of the most successful entrepreneur in the country.