If you want to start a bank or a mortgage company in Kenya, you need to follow the following procedure ,as explained by the Central Bank of Kenya

THE A-Z OF LICENSING A COMMERCIAL BANK, A MORTGAGE FINANCE COMPANY OR A NON-BANK FINANCIAL INSTITUTION

The following are the key steps to be followed in applying for licence to start a commercial bank, non-bank financial institution or mortgage finance company:-

- Contact the Central Bank of Kenya at an early stage for a preliminary meeting to discuss CBK licensing requirements and related issues.

- Seek CBK’s approval for the use of the word “bank’’ or “finance” in the proposed name.

- Once CBK has approved the name, apply to the Registrar of Companies for incorporation of the proposed bank, mortgage finance company or non-bank financial institution as a limited liability company.

- Upon incorporation of the limited liability company, apply to CBK for a banking, mortgage finance company or non-bank finance institution licence. At this stage you should contact the Bank Supervision Department at CBK or download and complete the following application forms which can be accessed from the Central Bank website: centralbank.go.ke:

- “Application form for a License to Conduct the Business of an Institution”

(Form CBK IF 1-1),

- “Fit and Proper” forms for proposed directors and Chief Executive Officer (Form CBK IF 1-2),

- “Fit and Proper” forms for all significant shareholders (Form CBK IF 1-3).

- The duly completed application form, Form CBK IF 1-1, should be forwarded together with the support documentation below:

- Certified copy of the certificate of incorporation of the institution.

- Certified copy of the Memorandum and Articles of Association of the proposed institution.

- Certified copy of the Memorandum and Articles of Association of any corporate body that proposes to have a significant shareholding in the institution.

- Certified copy of the latest audited financial statements for each of the three years immediately preceding the date of the application if the applicant has been operating in any sector under any name and laws or in cases where any of the shareholders is a corporate body.

- Where the proposed significant shareholders are natural persons, certified personal statements of affairs for the past three years should be submitted.

- All applications should be submitted together with a non-refundable application fee), payable by banker’s cheque in favour of the Central Bank of Kenya or such other mode of payment as the CBK may prescribe, as specified under the Fourth

Schedule to the Banking Act,(The Banking (Fees) Regulations. The application fee is currently Kshs 5,000.

- In case of an institution incorporated outside Kenya, in addition to notarized copies of the documents specified in (5) above, the following should also be submitted:

- A notarized copy of the signed minutes of the board of the institution or other prime oversight body passing the resolution to establish a branch or subsidiary in Kenya,

- An undertaking by the board or other oversight body to maintain minimum assigned capital in the proposed branch or subsidiary in Kenya as per the Banking Act and that such capital shall be in Kenya shillings,

- The name and contact details of a designated person(s) from the Head Office authorized to liaise with the Central Bank on the application on behalf of the institution.

- A letter of no objection from the home supervisory authority recommending the applicant to establish a branch or subsidiary in Kenya should be obtained. The letter should be forwarded directly to the Director, Bank Supervision Department, Central Bank of Kenya, P.O. Box 60000-00200, Nairobi.

- There shall be an understanding that the home country supervisor will exchange supervisory information with the Central Bank of Kenya.

- Confirmation from the home country supervisor that the promoters of the foreign incorporated bank do not operate a shell bank should be obtained.

- Where necessary, confirmation from the home supervisor that the supervisor conducts consolidated supervision.

- Sworn declarations signed by every officer as specified in the application forms.

- A feasibility study of the future operations and development of the intended business for a minimum period of three years from the date of the application including:

- A comprehensive diagrammatic representation of the group structure, if the applicant is part of a group of companies (either as a parent, associate, subsidiary or joint venture), indicating details of all respective individual and institutional shareholding within the group as well as the ultimate beneficial shareholders.

- Proposed organization structure for the proposed institution showing:

- Proposed Board of Directors.

- Proposed CEO, Executive Directors and Senior Officers.

- Proposed functional divisions.

- Up-to-date and detailed curriculum vitae of every significant beneficial shareholder, director and any senior officer who will take part in policy making, as well as certified copies of supporting documentation such as:

- Academic and professional certificates.

- Contact details (postal and e-mail addresses, phone contacts of at least three independent referees, one of whom should be a previous employer or business associate).

- Valid Personal Identification Number (PIN) and tax compliance certificate issued by the relevant tax authority in Kenya.

- The latest credit report from a licensed credit reference bureau.

- Certified statement of personal financial affairs.

- Two recent passport-size photographs.

- Schedule of all the preliminary expenses including organization costs, share-selling and brokerage costs and commission.

- Projections of financial statements for the first three years of operations.

- Interest rate sensitivity analysis of the projections submitted or other similar analysis of the extent to which the forecasts will change when interest rate vary (the assumptions underlying the projections and the sensitivity analysis should be stated).

- The proposed operational arrangements of the applicant – Show details of the proposed functional divisions and units, activities to be run in-house and those to be outsourced. Rationale for outsourcing and the risk-mitigation measures in place should be provided.

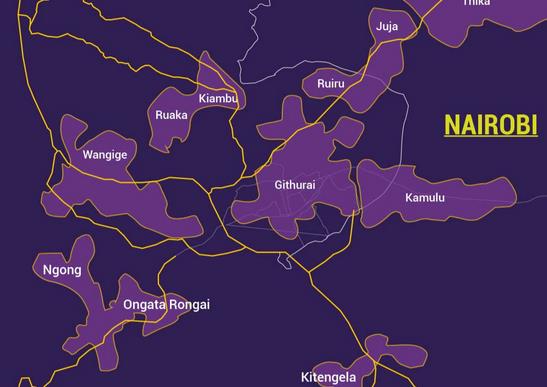

- Statistical and other data which may have been collected in respect of the area in which the applicant intends to serve including population of the area, schemes of agriculture, business, industrial development and existing banking facilities.

- Sources and evidence of availability of capital – Details of the sources of capital contributed by all proposed significant individual and institutional shareholders (e. those controlling, directly or indirectly, more than 5% of the applicant’s proposed issued equity) as well as capacity to meet the minimum capital requirements for the proposed institution as stipulated in the Banking Act should be demonstrated. Evidence to be submitted includes either copies of certified bank statements, Fixed Deposit Receipts (FDRs) or Government Securities. Currently a minimum capital of Kshs 1 billion is required to start a bank or a mortgage finance company.

- Every proposed individual and institutional shareholder should submit, as part of the sworn declaration in the “Fit & Proper Form”, CBK IF 1-3, a statement to the effect that the proposed capital is not from proceeds of crime or illicit activities.

- Upon meeting all the requirements, the Central Bank will grant the applicant an approval in principle to conduct the business of a bank, mortgage finance company or non-bank financial institution, as the case may be.

- With this approval, the applicants may proceed to obtain premises, Information Technology Systems, put in place other necessary operating facilities and recruit staff for the institution.

- Once the applicants are ready with their premises and systems, they should then invite the Central Bank to conduct an inspection.

- If the inspection is satisfactory, and prior to issuance of the license, applicants are required to pay the prescribed annual license fees as specified under the Fourth Schedule of the Banking Act. The prescribed annual license fees are payable in full for the year during which the license is initially issued, and shall not be prorated for validity periods less than 12 months.

- Once the requisite license fees have been paid, the Central Bank places a notice in the Kenya Gazette to formally specify the institution.

- A license is then issued and the newly licensed institution can open its doors to the public.