When you get a salary in Kenya, there are so many temptations you get that end up in self-destructive habits. I am one of those who were salaried before and I used my wisdom to ensure that at least 50% of my salary went to investments. Years move fast, faster than you expect and since after retirement you are required to eat what you saved/invested, it’s important to start investing early.

Here is how to spend your salary wisely in Kenya, especially for those working in Nairobi

- Reduce parties

Parties are important in one’s life, there is no individual who is comfortable without having fun win others. But when you party daily using your salary, eventually you’ll end up not saving any money.

If possible, hold at most one party in a month.

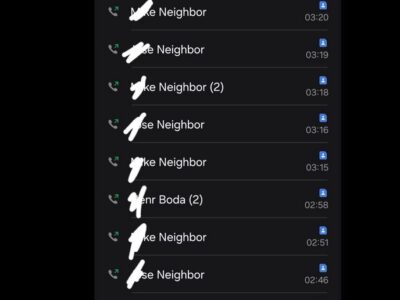

- Reduce the number of girlfriends to at most one

The more money you get, the higher the temptations of adding more girlfriends. The more girlfriends you have, the more you spend. Assuming that your monthly salary is Ksh 100,000 and you have 4 girlfriends who demand upkeep money and rent, do you think you’ll save any money?

It’s even better not to have any girlfriend in order to save as much money as possible.

- Live within your means

Don’t spend what you don’t earn. If your monthly salary is Ksh 50,000, your expenditure should not exceed Ksh40,000. The monthly rent should be Ksh10,000, food and other expenses Ksh20,000.

I know a number of individuals earning Ksh150,000 per month but living in houses they pay Ksh60,000. These people will never develop.

- Avoid emergency Mobile loans like Mshwari

Emergency loans come with interests. The more you take the loans, the more you develop appetite for more loans. Since it’s easy to get these loans, you find yourself spending lavishly. Eventually, you end up exhausting your income on paying the loans.

Avoid mobile loans as a plague—they won’t help you.

- Reduce the number of people depending on you

Don’t be too good for everyone. Most people know when things are working for you, even those who were not associating with you will come one by one. The moment you start earning money, make sure you drop almost all your friends, distance yourself from majority of family members and ensure you spend where necessary.

Most of those friends and family members eating your money now won’t be available when you go broke. They’re the ones who will laugh at you how you weren’t spending wisely.

- Spend less than a third of your salary on rent

There is no benefit you get when you spend almost all your money on rent. Of course living in Runda, Kilimani, Kileleshwa is comfortable, but one time your income will disappear. Let the rent not be a hindrance to personal financial progress.

For those earning Ksh 20,000, your monthly rent should not exceed Ksh5,000. If your income is Ksh100,000, you should spend less than Ksh 25,000 on rent.

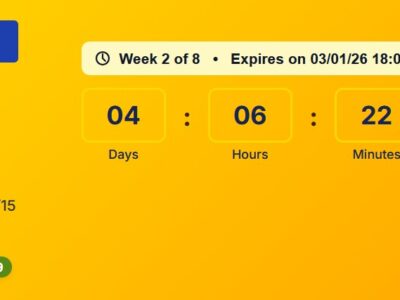

- Save/invest before you spend

The first thing you should do when you get employed is to open a fixed deposit account with a bank or Unit Trust account with an insurance company. Make sure that some amount is channeled to the accounts before getting your salary. Then plan on what you receive after investing.

- Reduce unnecessary miscellaneous expenses

If you should buy a car,buy one that is not a fuel guzzler.All you need in a car is to take you from point A to point B. Unless you are living in your own compound, don’t buy an expensive car to please your peers.

Build your own home

If you manage to build your new home, you’ll cut expenses bay almost half.This is something you should give first priority.