Certified Public Accountants (CPA) is the most popular professional course in Kenya. The program is offered by KASNEB alongside other professional certificates.

CPA contains the following units:

PART I

Section 1

Paper No:

CA11 Financial Accounting

CA12 Commercial Law

CA13 Entrepreneurship and Communication

Section 2

Paper No:

CA21 Economics

CA22 Management Accounting

CA23 Public Finance and Taxation

PART II

Section 3

Paper No:

CA31 Company Law

CA32 Financial Management

CA33 Financial Reporting

Section 4

Paper No:

CA41 Auditing and Assurance

CA42 Management Information Systems

CA43 Quantitative Analysis

PART III

Section 5

Paper No:

CA51 Strategy, Governance and Ethics

CA52 Advanced Management Accounting

CA53 Advanced Financial Management

Section 6

Paper No:

CA61 Advanced Public Finance and Taxation

CA62 Advanced Auditing and Assurance

CA63 Advanced Financial Reporting

Certified Public Accountants are skilled and competent professional accountants, auditors, finance managers, tax consultants and practitioners both in public and private sectors.

Every Kenyan pursuing business related courses, statistics, actuarial science, engineering, real estate and any related course is advised to enroll for CPA so as to boost the chances of employment and promotions. Bachelor of Commerce graduate without CPA or a related professional certification is almost a useless degree, especially in this era when buying a degree course is the norm.

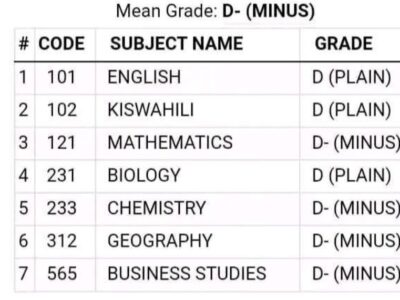

Many students are advised to enroll for CPA immediately after completing KCSE.But you should be aware these are minimum entry requirements:

- Kenya Certificate of Secondary Education (KCSE) examination with an aggregate average of at least grade C+ (C plus) provided the applicant has obtained a minimum of grade C + (C plus) in both English and Mathematics or equivalent qualifications.

- Kenya Advanced Certificate of Education (KACE) with at least TWO Principal passes provided that the applicant has credits in Mathematics and English at Kenya Certificate of Education (KCE) level or equivalent qualifications.

- KASNEB technician, diploma or professional examination certificate.

- A degree from a recognised university.

- International General Certificate of Secondary Education (IGCSE) examination grade C in 6 papers with C in both English and Mathematics.

- Such other certificates or diplomas as may be approved by KASNEB.

If you enroll for CPA immediately after form four, you will take two years to complete the program. By the time you reach third year in college, you have your CPA certificate and also you are a member of ICPAK.With this qualification, in addition to your degree, you will have an upper hand when seeking employment.

Fees structure for CPA indicates that you must set aside Ksh 30,000 for the program. This money is inclusive of the cost of reading materials, training, examination & registration fee.

When it comes to the job market and employment opportunities, it’s obvious every employer demands that their workers must possess CPA, especially if you are an accountant or business analyst. Compared to job seekers with no CPA or any other professional course, you are much better.